Sustainability at Investment Manager level

Independent – entrepreneurial – committed

This is what distinguishes Bellevue Asset Management, the delegated investment manager and administrator of BB Biotech AG. As an authorized manager of collective assets regulated by the Swiss Financial Market Supervisory Authority FINMA, Bellevue Asset Management AG is fully owned by Bellevue Group AG, an independent financial boutique listed on the SIX Swiss Exchange.

Bellevue Group AG publicly reports as follows:

We act responsibly. Strong corporate governance is just as central to this as sustainability aspects, whether at the Investment Manager level or as an integral part of portfolio management.

Independent

Our most important asset is our experts with top know-how. We work in small, agile teams that are characterized by a high degree of personal responsibility and short decision-making paths. The portfolio management teams are given as much freedom as possible to develop their vision and assume a high degree of personal responsibility. This autonomy enables them to act optimally and respond flexibly to customer needs. What they have in common is a set of rules anchored throughout the company with regard to sustainable corporate and investment practices.

Entrepreneurial

Full of conviction, we also actively participate in investments ourselves – and thus in the success of our customers: «We eat our own cooking.» The equality of interests with the investors promotes discipline as well as entrepreneurial thinking and acting.

Committed

We are performance-driven and passionate about pursuing common goals and believe in the power of respectful collaboration. We bring our expertise and competence to important social issues and act responsibly.

We consider good corporate practices, a binding framework for our organization, and social considerations to be indispensable success factors.

Core values

Based on our core values («independent», «entrepreneurial», «committed»), we maintain a binding framework for our organization and our employees regarding ethical, responsible and sustainable business practices. The ESG policy governs standards and behaviors related to environmental, social and governance aspects.

Environmental practices

Within the framework of our work processes, we attach importance to environmentally friendly practices and ensure this in particular with the following measures:

Energy consumption

At Bellevue Asset Management’s headquarter in Küsnacht/ZH, the building as well as the premises of our data centers are heated and cooled with natural lake water, already for almost two decades. Besides automatic control of awnings, further improvements such as energy-efficient window glass to reduce energy consumption were added a few years ago to improve the workplace’s climate regulation and energy efficiency.

When procuring power-operated equipment such as PCs, monitors, printers, etc., we make sure to use energy-efficient equipment. Increased awareness for all employees to optimize energy consumption and automatic controls switching IT components to standby mode, either individually or in groups, according to predefined time patterns are further measures to reduce energy consumption. The buildings are only lit when they are in use. We use additional energy consumers such as air conditioners or radiators only for extreme external weather conditions.

Over the weekends, the company premises are only heated to minimum levels.

Transportation and mobility

Our locations are very easy to reach by public transport. Employees are motivated to travel by public transport. The company supports this through financial support by providing a half-fare Travelcard of Swiss public transport free of charge. Parking spaces are not subsidized and are charged at full market rates.

Due to our global investment strategies and distribution activities with employees at different locations, international contacts are important. All locations have a video conferencing infrastructure. Most of the meetings are through telephone and video conferencing as a substitute for physical meetings to limit travel. Where possible and appropriate, we substitute air travel with public transportation such as train travel and coordinate joint site visits.

The executive management board is regularly informed about the travel activities of the employees.

Procurement process

When procuring materials, furniture, food, etc., we consider local suppliers and local products wherever possible in order to reduce the environmental impact. Likewise, when selecting suppliers and service providers, their environmental practices are taken into account. When procuring furniture and other office materials, we pay attention to durability.

CO2 neutrality

Bellevue Group was certified as a climate-neutral company by Swiss Climate in 2021. By purchasing CO2 emission certificates in the amount of the greenhouse gas emissions emitted annually (263t), we support projects that save the same amount of emissions. Bellevue Group has selected a project focusing on «Climate protection and sustainable management in the Swiss forest» for climate neutrality in 2021. The project ensures CO2 storage and sustainable management of 7 279 hectares of forest in the canton of Schwyz. This protects the climate, preserves biodiversity in the Swiss forest and enables the production of energy wood for renewable energy production. As part of the certification, Bellevue Group has set a reduction target of 30% of emissions per FTE by 2030. The CO2 emissions in 2020 adjusted for COVID-19 effects serve as a basis.

Waste management and recycling

Systems are in place at all sites to collect and recycle a wide range of materials, including cardboard, PET, glass, paper, batteries and IT equipment. We separate waste and dispose of it properly. We take care at the procurement stage to avoid excessive waste or other unnecessary environmental impact (e.g. use of washable dishes instead of disposable cups/plates). In addition, water filtering devices are installed to reduce PET bottle consumption. Paper consumption is a significant resource for a service company. We take appropriate measures to ensure that paper consumption is constantly reduced and can be replaced by other means (e.g. customer presentations on notebooks/tablets instead of printed handouts, video calls for customer meetings, annual reports printed on FSC paper, shipping only on request). Print programs are initialized so that printouts are two-page and black and white by default.

Environmental indicators

The environmental indicators were determined for the first time in 2021 for the 2020 financial year. In the future, the updated values will be published with the semi-annual financial statements for the following year.

Emissions

|

Total emissions (in t CO2) |

|

2020 |

|

CO2-emissions scope 1 |

|

32.3 |

|

CO2-emissions scope 2 |

|

44.3 |

|

Co2-emissions scope 3 |

|

186.4 |

|

Total CO2-emissions |

|

262.9 |

|

CO2-emissions/full-time position |

|

2.7 |

|

|

|

|

|

Scope 1: Direct greenhouse gas emissions |

|

|

|

Scope 2: Indirect energy-related greenhouse gas emissions |

|

|

|

Scope 3: Energy supply (energy-related emissions not received in scope 1 or 2): business travel (external vehicles), commuting, IT equipment, paper, print jobs, waste, water |

|

|

Total emissions at a glance

In the future, the 2020 balance with normalized data in the categories commuter trips and business flights will be used as a reference balance to assess the efficiency of the measures implemented as part of the climate policy and to show improvements in the CO2 balance.

|

Total emissions (in t CO2) |

|

Base year* |

|

2020 |

|

Business trips |

|

505 |

|

99 |

|

Heating |

|

58 |

|

58 |

|

Commuting |

|

130 |

|

55 |

|

Electricity |

|

32 |

|

32 |

|

IT equipment (computers, laptops, monitors, cell phones, phones, tablets) |

|

14 |

|

14 |

|

Waste |

|

2.5 |

|

2.5 |

|

Water |

|

1.5 |

|

1.5 |

|

Paper and printing |

|

0.9 |

|

1.2 |

|

Total emissions |

|

744 |

|

263 |

|

Emissions Total / FTE (t CO2/FTE) |

|

7.7 |

|

2.7 |

* Base year: 2020 adjusted for COVID-19 effects (travel / home office).

Source: C02 Report for Bellevue Group AG issued by Swiss Climate AG (November 2021)

Bellevue Group’s operations include four focus areas related to CO2 emissions: Business travel, commuting, heating and electricity. These account for 93% of emissions. The effects of the measures against COVID-19 dispersion are particularly evident in business travel. Air travel and commuting account for over 85% of CO2 emissions in a normalized year. Since air travel was limited since March 2020 and home office recommendation or duty massively reduced commuting, CO2 emissions in 2020 are reduced by about 65% due to COVID-19. Post the pandemic, significantly more business travel is expected again.

Social practices

Employee selection

For a service company like Bellevue Asset Management, employees are the most important asset for the company’s long-term success. The added value that Bellevue Asset Management generates for its investors in managed companies and investment funds is inextricably linked to the expertise, motivation and high level of identification of its employees with the company. Accordingly, we place great emphasis on the careful selection of suitable talent. The suitability of a candidate is usually assessed over several selection stages and assessments. In addition to professional competence, soft skills, team spirit and compatibility with corporate values are also assessed. From the employees’ point of view, the manageable size of the company and the resulting personal contacts are a key success factor. Criteria such as age, religion, origin and gender must not lead to discrimination.

Work culture

We maintain a strong entrepreneurial culture with flat hierarchies, a high degree of self-responsibility and flexibility with regard to working hours, workload and work location. The company organization is designed to enable employees to develop and use their respective professional talents in the best interest of the company’s stakeholders, always taking into account the family and personal environment (e.g. part-time work, IT setup for home office, support for training and further education).

The respectful and responsible attitude towards employees is reflected both in the daily mutual exchange and in regular institutionalized employee appraisals. These provide the framework for personal assessment and planning of further development. We support targeted training and further education both ideally and materially, thus enabling employees to benefit from a conducive and stimulating learning environment.

Health

The health and safety of our employees and all people affected by our business activities is our top priority. As an employer, we can have a significant impact on the health of our employees through various measures and support them in remaining healthy and motivated in the long term.

We promote motivation and health through various measures. These include access to healthy food/snacks, an annual subscription to a professional medical gym and other subsidized sport activities.

All workplaces are also equipped with height-adjustable desks and sufficient natural daylight.

Every year, employees are also offered free vaccination such as against influenza or against tick borne encephalitis.

The «Bellevue Team Spirit» is promoted and strengthened by regular social events such as joint lunchtime barbecues, summer parties and skiing events in winter.

Analyzing and investing in healthcare companies is an important part of Bellevue Asset Management. Our experts regularly lecture both internally and externally on current health topics. Discussions on relevant issues (e.g. increases in diabetes due to poor diet and lack of exercise, liver diseases, etc.) stimulate awareness of health among employees.

Equality (diversity, equal opportunities and non-discrimination)

Bellevue Group provides equal employment and advancement opportunities to all individuals regardless of age, race, ethnicity, gender, sexuality, disability, religion or other characteristics. That’s why we benefit from a diverse workforce: With their different perspectives and approaches, experiences, ideas and skills, employees inspire each other and learn from each other. As a result, the company gains creativity, innovation and vision to remain future-proof and agile.

We foster a culture of gender equality and promote a balanced mix of gender and age across all hierarchical levels and functions of the company. Employee compensation is periodically reviewed for unjustified differences and adjusted if necessary. The last analysis was carried out in August 2021 using the standard federal analysis tool («Logib»). No gender effect was identified.

Both genders should be represented in the executive management board and on the Board of Directors. Discriminatory behavior will not be tolerated; incorrect behavior will be punished by superiors.

|

People indicators |

|

2021 |

|

2020 |

|

Average length of service of employees |

|

6.4 years |

|

5.7 years |

|

Average age |

|

45 years |

|

44.5 years |

|

Part-time employees |

|

22% |

|

23% |

|

Employee turnover |

|

2.90% |

|

2.60% |

Source: Bellevue Group AG, as at December 31, 2021

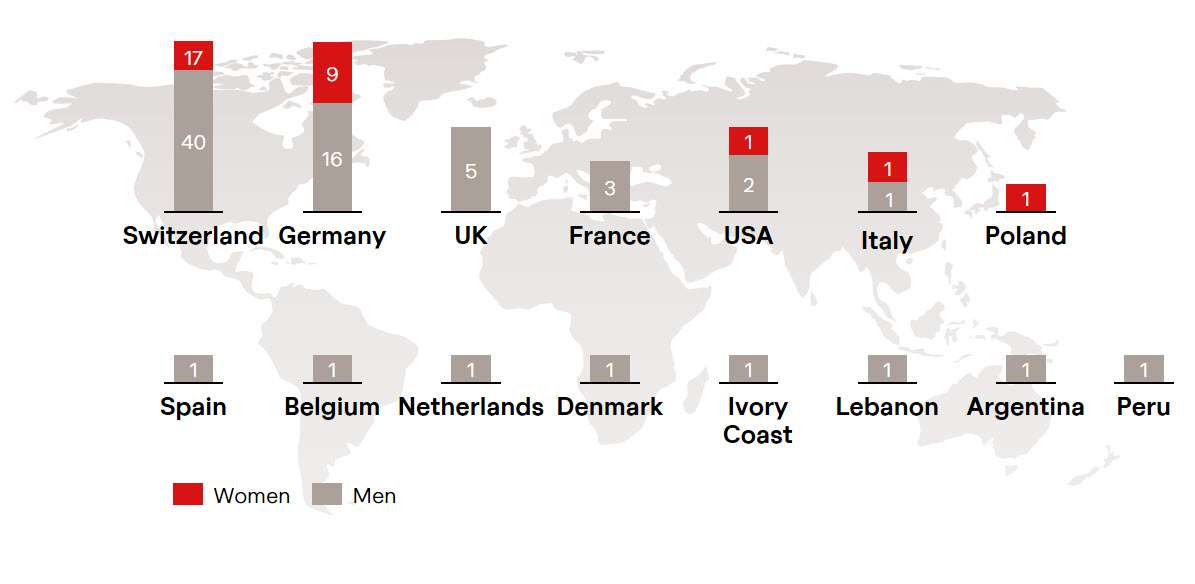

Diversity indicators 2021

Proportion of women

Gender diversity: Bellevue Group has set the goal of continuously increasing the proportion of women at all levels, particularly at senior management levels, in the company by promoting the development and retention of women.

15 nationalities

Compensation policy

In the spirit of identification with the company and the entrepreneurial activities of each employee at his or her level, we give employees across all hierarchical levels a share in the success of their own company.

Part of the variable salary components (profit-sharing) are distributed in the form of treasury shares or fund units and remain blocked for a predefined period. In this way, the interests of employees are to a large extent aligned with the interests of investors, shareholders and other stakeholders.

Furthermore, Bellevue Asset Management periodically offers an employee share ownership program under which rights to purchase Bellevue Group shares are offered at a discounted purchase price.

The compensation of Bellevue Asset Management employees is designed to motivate employees in all units to perform very well. This is «entrepreneurial compensation with commitment» – a meritocratic model. An attractive entrepreneurial profit-sharing bonus is available as variable compensation. This profit-sharing is directly linked to the operational financial performance of Bellevue Group. In addition, part of this variable profit-sharing is paid out in the form of blocked shares and commitments in managed products (credo: «We eat our own cooking»). This approach promotes a long-term performance culture. Further details and numbers are publicly disclosed in the audited annual compensation report of Bellevue Group AG.

Education and training

Lifelong learning is becoming increasingly important. We attach great importance to encouraging employees to take responsibility for their own professional development. Bellevue Group supports its employees in external training courses where this makes sense. These mainly include business-specific qualifications such as CFA, CAIA, etc. as well as language courses. Depending on the educational objective, we also participate in external training courses by releasing working hours and/or providing financial support. The cost of individual one-day seminars is covered in full by the employer. All Bellevue Group employees are regularly required to complete e-learning modules in the area of cyber security.

In the financial year 2022, ESG related KPI’s and personal goals are part of the annual performance assessment for every portfolio manager.

Self-management of the pension fund

Employees’ pension assets are held in a separate pension fund, managed by Bellevue Asset Management AG. Employer contributions are above the legally required minimum. Funds of the pension foundation are also invested in companies and investment funds that we manage. In this way, we underline our own convictions, which we represent to our clients and investors.

In order to succeed, we believe that our employees need to be agile and connected: Employees who depend on the use of a tablet and/or a cell phone for business purposes can, with the approval of their superiors, claim a pro-rata reimbursement for the purchase of a tablet and/or a cell phone every two years. The communication and data subscription is ordered centrally by Bellevue Asset Management. The corresponding costs are borne by the employer with a minor contribution of the employees in accordance with the expense regulations approved by the cantonal tax office.

Home office

Bellevue Asset Management, as a modern employer, allows its employees to work from home. Employees appreciate the flexibility and the fact that there is less commuting burden as well as an improved work-life balance.

Digitalization

To meet the constantly changing demands of customers and employees, internal processes are optimized and the use of new technologies is promoted. The digital transformation leads to new forms of communication, promotes transparency and efficiency, and is intended to make the entire company more agile in order to ensure its long-term competitiveness.

In the course of this, several projects and initiatives were launched: a new integrative portfolio management system offering consistent data management, reporting and risk management on one platform, a dedicated tool for the Private Market team, and the introduction of company-wide communication and working tools.

Donations and charity

Bellevue Asset Management selectively supports a number of organizations in the areas of charity, sports, culture, scientific recognition/education and society. We do this out of conviction and therefore refrain from naming most of them publicly.

Corporate practices

We see good corporate practices as a key success factor and an indispensable prerequisite for achieving strategic corporate goals and creating sustainable value for stakeholders such as customers, employees, shareholders, the interested public, the environment and society. We recognize that business activities inevitably have a direct or indirect impact on the environment, social affairs and governance, and that we are responsible for this.

As a listed company, Bellevue Group AG reports transparently on governance topics in the annual report as part of our compliance with the Corporate Governance Directive (DCG). An independently audited compensation report provides information on compensation paid to the Board of Directors and Group Management. The four-member Board of Directors is international and interdisciplinary in its composition and has in-depth expertise in various areas. An important element of corporate governance is the clearly defined, balanced distribution of responsibilities between the Board of Directors and the Group Executive Board. The country-specific requirements of each location are taken into account. Find out more in Bellevue Group’s Annual Report.

In the following, our management approach of sustainability risks and ESG integration approach are described in detail:

Transparency

In accordance with Regulation (EU) 2019/2088 of the European Parliament and the Council of the European Union of November 27, 2019 on sustainability-related disclosures in the financial services sector, Bellevue Asset Management is committed to transparency with respect to:

- Policy for managing sustainability risks,

- Adverse sustainability impacts at entity level

- Compensation policies in relation to the integration of sustainability risks

- Adverse sustainability impacts at financial portfolio level

- Promotion of environmental or social characteristics in pre‐contractual disclosures,

- Sustainable investments in pre‐contractual disclosures,

- Promotion of environmental or social characteristics and of sustainable investments on websites

- Promotion of environmental or social characteristics and of sustainable investments in periodic reports

Sustainability risks

«Sustainability risks» is defined in Regulation (EU) 2019/2088 of the European Parliament and of the Council of the European Union of November 27, 2019 on sustainability-related disclosures in the financial services sector (Sustainable Finance Disclosure Regulation, SFDR) as an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment.

Bellevue Asset Management AG and its subsidiaries have integrated sustainability risks into the investment decision-making processes of all their actively managed strategies and associated funds with the aim of identifying, assessing and, if possible and appropriate, mitigating such risks.

While every investment strategy can be exposed to such sustainability risks to varying degrees, the projected impact of sustainability risks on the returns of the investment strategies will depend on the specific investment strategy.

More than 80% of our assets under management (as at December 31, 2021) are invested in the healthcare sector, which is characterized by lower levels of carbon emissions than the manufacturing, commodities or energy sectors and the broadly diversified global equity indices. Our focus on healthcare therefore reduces the sustainability risks.

The results of this integration and evaluation are summarized as follows:

For those investment strategies that promote environmental or social characteristics in the sense of SFDR, the projected negative impact on financial returns is lower compared to «non-ESG» investment strategies. This is attributed to the risk-mitigating ESG investment strategies, their future-oriented investment approach, their emphasis on sustainable financial frameworks, their activism in dealings with companies/issuers as well as their avoidance of non-compliant companies/issuers.

All investment strategies may invest in accordance with international environmental, social and corporate governance standards (hereinafter referred to as «ESG»). The investments or securities selected in accordance with such criteria can entail a significant subjective element. ESG factors that are integrated into the investment process may differ with respect to investment themes, investment categories, investment philosophy and the subjective application of ESG indicators that determine portfolio design and the underlying assets. Accordingly, no guarantee is made that every investment by an investment strategy will meet all of the ESG criteria.

ESG investment policy

ESG framework in portfolio management

The ESG investment policy of Bellevue Asset Management encompasses following key elements:

Exclusion of breaches against global norms

Bellevue Asset Management is committed to adhering to internationally recognized norms and excludes companies with serious violations of human rights, environment, labor norms and involvement in corruption. No investments may be made in companies that are implicated in serious environmental, human rights and business ethics issues. Compliance with the principles and guidelines of the UN Global Compact and the UN Guiding Principles on Business and Human Rights and with the standards and rights of the International Labor Organization serves as an indicator in such cases. Bellevue Asset Management AG also systematically excludes investments in companies associated with controversial weapons.

Value-based exclusions

In contrast to exclusions based on violations of global principles and standards, norms-based exclusions are based on social, ethical or moral values. Companies with business activities in areas that are considered controversial according to prevailing social views will be excluded from Bellevue Asset Management’s investment universe. With respect to ethically and morally controversial business areas, no investments will be made in companies whose sales in such areas exceed the following thresholds relative to total revenues, which have been defined in accordance with generally recognized tolerance levels.

|

Business area |

|

Revenue threshold |

|

Controversial weapons |

|

0% |

|

Conventional weapons |

|

10% |

|

Thermal coal |

|

5% |

|

Fracking/oil sands |

|

5% |

|

Production of tobacco |

|

5% |

|

Sale of tobacco |

|

20% |

|

Pornography |

|

5% |

|

Gambling |

|

5% |

|

Palm oil |

|

5% |

Company affiliations with animal experiments, medical genetic engineering and embryonic stem cell research may also fall into this category. As a healthcare investment specialist, Bellevue Asset Management applies a nuanced approach in this respect. Their healthcare strategies accommodate generally recognized principles where possible. They categorically rule out investments in companies associated with illegal activities, an example of which would be intervention in the human genome for cloning purposes. However, nowhere in the world can medical products be approved without animal testing, even today. Their healthcare experts prioritize compliance with humane animal research principles in line with the principle of the 3Rs: Replace, Reduce and Refine.

ESG integration

Bellevue Asset Management’s investment process also entails – in addition to its conventional investment research – an «ESG integration approach», which refers to the sub-categories Environment («E»), Social («S») and Governance («G»). The Environment sub-category focused on aspects such as whether a company systematically measures its carbon footprint and discloses the related data. The Social sub-category covers aspects such as product quality, data privacy policies and human capital development. Examples of Governance issues are board independence, board compensation and corporate ethics.

Based on the premise that sustainability risks can have a negative impact on returns, the aim of ESG integration is to identify and address such risks within the scope of the investment process. The data gained through ESG screening is also used by the asset manager to anticipate new developments with respect to sustainability and to incorporate these findings into its investment decisions.

A system of ESG ratings forms the basis by which sustainability criteria are integrated into the asset manager’s investment decision process. Every issuer of securities in its investment universe is assigned an ESG rating based on various sub-scores. These sub-scores are based on data from MSCI ESG, if available. Any data gaps or objective misjudgments resulting from shortcomings in the ESG rating methodology are addressed to the best of the asset manager’s knowledge and ability through in-house evaluations based on fundamental research or by referencing other data sources (e.g. Bloomberg).

Subsequently, the relevant ESG factors for an industry or individual company, examples of which are product quality, data privacy, human capital development and corporate ethics, are qualitatively integrated into the regular fundamental research process, in which metrics such as valuation multiples, sales growth rates, profit margins and competitive positions are examined, and thus help the asset manager to make sound security selection and portfolio weighting decisions.

Most ESG rating methods are based on a predefined systematic approach, although this does not always result in an objective or «fair» assessment of a company’s ESG risks. In fact, such methods often systematically disadvantage start-ups and small-cap companies relative to large-cap companies. A lack of manpower and experience in handling ESG issues can result in a company being underrated, and the rating methodology used might not be equally applicable to every company in a given sector. In the biotech industry, for instance, early stage companies still in the drug research and development stage may be systematically underrated because they are not yet generating (much) revenue from the sale of medicines, which naturally puts them at a disadvantage versus established healthcare giants in the highly weighted «access to healthcare» criterion. It is also not unusual for a newly listed company to have a weaker ESG rating, simply because the ESG data available is still insufficient. That is why Bellevue Asset Management’s portfolio managers always take a closer look at ostensible «ESG laggards» and reach out to the ESG specialists at its external ESG research providers and at the companies with lagging ESG ratings.

Bellevue Asset Management does not apply a «best-in-class» approach for the reasons mentioned above, unless otherwise dictated by a specific investment strategy.

ESG stewardship

Portfolio managers are engaged in an active and constructive dialog with the executives and other relevant stakeholders of portfolio companies on environmental, social and governance issues. If there are any indications of a significant controversy related to ESG issues before a company representative is contacted, the portfolio managers constructively discuss the issue with the company and document subsequent developments (e.g., change in strategy or processes, improvement of ESG rating) over time. Engagement will be undertaken taking into account materiality and proportionality considerations. The level of engagement can vary depending on the size of the position held by an investment strategy, the market capitalization of the company, the stage of corporate development an entity is in and other factors. Written records of ESG engagement activities are maintained as part of the regular documentation of conversations with company representatives. Individual case studies may be suitable for external publication and thus for distribution to a wider audience.

Bellevue Asset Management also protects the long-term interests of its investors by making active use of its voting rights at the general meetings of shareholders of the companies in its portfolios via proxy voting. Voting guidelines issued by third parties, for example by independent sustainability and voting rights organizations, can be taken into consideration. Bellevue Asset Management is under no obligation to take such guidelines or recommendations into consideration. It may go against the voting recommendations of third parties if it determines that these are not in the best interests of the investors.

Bellevue Asset Management actively exercises its voting rights as a rule.

It generally votes in line with the recommendations of company boards regarding agenda items that will not have a material impact on the long-term development of the company in question. Agenda items that we believe could have a material impact on the long-term development of the company will be examined in detail before deciding how to vote. Below are typical examples of such items:

- Mergers and acquisitions

- Divestment of business units

- Changes in capital structure or outstanding voting rights

- Corporate governance matters (acquisitions, restructuring projects, etc.)

- Compensation and incentive schemes

- Board composition

The responsible portfolio managers will conduct this analysis. The analysis is based on the currently available information from various sources, for example, analyst reports or media releases and other reports published by the company itself.

Voting rights can be exercised directly through active participation in a general meeting; via an online voting platform (e.g., Broadridge or ISS) or through one or several representatives/proxy advisory firms.

Climate change factors

Bellevue Asset Management endorses the goals of the Paris climate agreement adopted in December 2015 and supports measures to mitigate global warming. Considerable importance is attached to green investment portfolios which can help to achieve the climate goals of the Paris Agreement. Carbon intensity (tons of carbon emitted per USD 1 mn of revenues) is measured regularly at portfolio level and scored based on the relevant investment universe or fund benchmark. It should also be noted that more than 80% of our assets under management (as at December 31, 2021) are invested in the healthcare sector, which is characterized by lower levels of carbon emissions than the manufacturing, commodities or energy sectors and the broadly diversified global equity indices.

UN PRI Signatory and sustainability labels

Our commitment to sustainability is reflected in Bellevue Asset Management AG’s status as a signatory of the UN Principles for Responsible Investment (UN PRI) as of August 2019. As a responsible institutional investor, we have always been bound to act in the best interests of our stakeholders over the long run. In this role, we believe that environmental, social and corporate governance (ESG) topics will have a growing impact on the risk-return profiles of investment portfolios and on their performance. We acknowledge that adherence to these basic ESG principles will lead to a better alignment between investor interests and the broader aims and interests of society.

Bellevue Asset Management has also been awarded the Austrian Ecolabel for its Bellevue Sustainable Healthcare (Lux) Fund every year since 2018 and was awarded an FNG label for its Bellevue Sustainable Entrepreneur Europe (Lux) Fund in 2021. Both funds are also signatories to the Eurosif Transparency Code for sustainable investment products, which reflects the asset manager’s strong commitment to high levels of transparency with respect to sustainability within the investment process.