Investment process

Idea generation and pre-screening

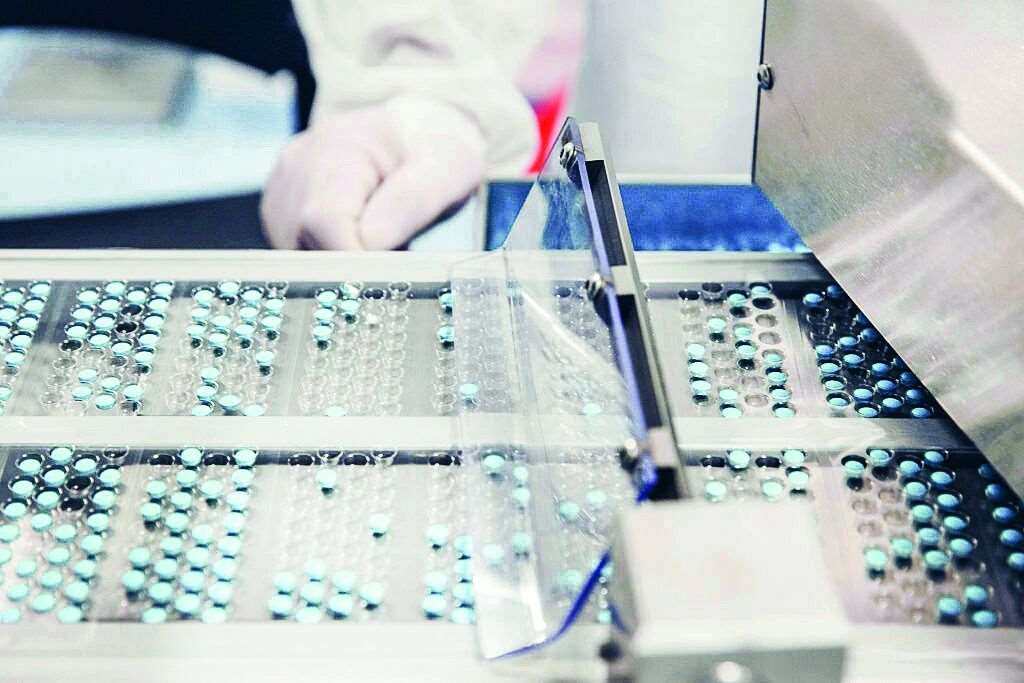

The investment universe for BB Biotech comprises about 1000 companies in the biotech industry worldwide. It includes large caps to micro caps and even later-stage private companies.

The investment management team of Bellevue Asset Management AG monitors this industry actively. In an initial phase the team identifies disease areas where major progress is being made, technological advances are promising, new mechanisms of action are being discovered or technology platforms that could be leveraged for multiple therapies are being developed.

To stay highly informed, the team talks to analysts, conducts interviews with doctors and specialists, attends medical conferences, reviews scientific literature, and visits companies on-site. The team also regularly evaluates the geographical allocation of its investments by visiting countries or areas that show interesting developments.

Once promising investment themes (disease area, technology, etc.) are identified, the universe is reduced from 1000 companies to about 300.

Due Diligence

With the due diligence process the focus switches from themes to individual companies and products. Qualitative as well as quantitative screening criteria are applied. Again, doctors and specialists are consulted to learn more about different drug candidates. The objective is to understand the innovation behind a product, to see what benefit the product could provide for the patient, but also if the product makes sense from a health economic standpoint.

BB Biotech tries to focus on products that are novel and essentially reduce healthcare costs because of their higher efficiency or better safety. The time horizon for these investments is mid- to long-term. Another important point is the quality of the management, which is assessed in discussions during company meetings.

For about 100 companies the team has created and maintains financial models that help to assess the financial position of the company and get a sense of market opportunities or to review the clinical data companies have produced and presented. At the end of this phase the team discusses the investment cases and selects the most promising ideas.

Investment decision and portfolio construction

If the team feels comfortable with an investment idea, the analyst that covers the company prepares a detailed investment proposal. This includes a financial model, a summary of the clinical data the company has presented, the investment rationale with potential upside and downside as well as the proposal of the size of the investment and at what price range the investment should be built up. This proposal is then presented to the Board during the monthly calls, where the Board of Directors and the team engage in an active discussion about the potential investment. The Board secures compliance with the investment strategy.

BB Biotech also holds biannual strategy meetings, where the Board and the Investment Management Team review strategic developments in the biotech industry and meet with the management of the portfolio holdings or of potential investments.

The investment managers build the position in a relatively short time, provided that the price levels are within the approved range for investment. This results in a biotech portfolio of around 20 to 35 companies.

Monitoring and risk management

Once the portfolio is established, the monitoring and risk management processes begin. The development of the drug candidates is monitored closely with new clinical data becoming available at medical conferences. The validity of the investment case is continuously assessed as the team regularly meets with management and keeps the financial model updated.

If there is a substantial change in the underlying value of a company that requires action, the team will inform the Board to increase the position, or to exit it, depending on what the reasons for the change are.

Additionally, the portfolio managers may adjust the positions in the portfolio by buying when prices are lower than the Net Asset Value estimated with the help of financial modeling or by selling a part of the position on strength, if a stock looks relatively overvalued. However, the Board is always involved in major changes. The portfolio is also monitored with the help of risk management software.