Shareholder letter

Dear Shareholders

In the second quarter 2024, equity markets extended their rally, reaching new all-time highs. Markets are carefully monitoring economic data to assess possible rate decisions by the US central bank and continue to expect one or two rate cuts in late 2024. Large technology stocks continued to be a dominant factor in the equity markets run-up, with the Nasdaq significantly outperforming the broader equity indices.

The healthcare sector did not keep up with the technology indices or other broad equity indices and consolidated in the second quarter. Biotechnology stocks traded slightly better with small gains for the index driven by larger cap holdings and select midcap companies. In general, smaller capitalized biotech companies have been lagging and have given back some of the fourth quarter 2023 and Q1 2024 rally.

The S&P 500 saw an increase of 4.3% in USD, and the Nasdaq Composite Index advanced by almost double that at 8.5% in USD. European stocks, with the Euro Stoxx 50 as a measure, consolidated and slightly declined by 1.6% in EUR. Similarly, the MSCI World Healthcare Index traded sideways and closed the quarter with a small gain of 0.6% in USD, with the Nasdaq Biotechnology Index surpassing the broad healthcare markets with a modest total return of 2.8% in USD.

Small-cap biotechnology companies, mostly in the sub 1 bn market cap segment, corrected. M&A activity, often a crucial element and performance contributor, was muted in the second quarter. Illustrative of this trend is the XBI, which achieved a total return of –2.2% in USD, underperforming the large-cap-dominated NBI Index's return by 5.0% in USD.

BB Biotech’s performance for the second quarter and first half of 2024

For BB Biotech AG, the share price return in the second quarter of 2024 was –12.0% in CHF and –11.3% in EUR. This disappointing second quarter development was driven by BB Biotech shares trading from a small premium at the beginning of Q2 2024 to a high single-digit discount by the end of the second quarter, and a negative development for the portfolio during the same time frame. The portfolio's total return was –3.5% in CHF, –2.6% in EUR, and –3.3% in USD. Overall, the net loss for the second quarter of 2024 amounted to CHF 87 mn, in contrast to a net loss of CHF 13 mn during the same period in 2023.

For the first six months of 2024, the total return for BB Biotech’s shares was –2.0% in CHF and –4.6% in EUR. The portfolio performance was +7.3% in CHF, +3.5% in EUR, and +0.4% in USD. Over the last few years, central bank policies impacted not just the equity markets; notably, the Swiss National Bank's second rate cut in 2024 caused the Swiss Franc to weaken against other major currencies like the USD. This devaluation provided some support to the portfolio performance in CHF in the first half of 2024 due to the USD's strengthening against the Swiss Franc. All results reported for H1 2024 include the dividend payment of CHF 2.00 per share in late March 2024. The net profit in the first half of 2024 amounted to CHF 173 mn compared to a loss of CHF 267 mn in H1 2023.

Leadership change in the Investment Management Team

Dr. Daniel Koller has informed the Board of Directors of his intention to retire from his position as head of BB Biotech’s Investment Management Team. He has served 20 years in BB Biotech’s Investment Management Team, since 2010 as its head. The Board and Dr. Koller will ensure an orderly transition until the end of 2024. In his role Dr. Koller has made significant contributions over the years. The Board would like to thank Daniel for his outstanding service and dedication to BB Biotech’s shareholders, the Investment Management Team, and the Biotech sector as a whole.

Dr. Christian Koch, one of the two deputy heads of the Investment Management Team and a portfolio manager at Bellevue Asset Management since 2014, will become head of the Investment Management Team at the beginning of 2025. The Board is convinced that Dr. Koch has excellent skills to lead the next phase of BB Biotech’s evolution in a complex market environment.

From 2013 to 2014, Dr. Koch was a sell-side pharma & biotech equity analyst at Bank am Bellevue in Küsnacht and from 2010 to 2013 a research associate at the Institute of Pharmaceutical Sciences at the ETH Zurich. He holds a PhD in Computer-Assisted Drug Design from the ETH Zurich and studied Bioinformatics at the Goethe University Frankfurt.

Portfolio update Q2 2024

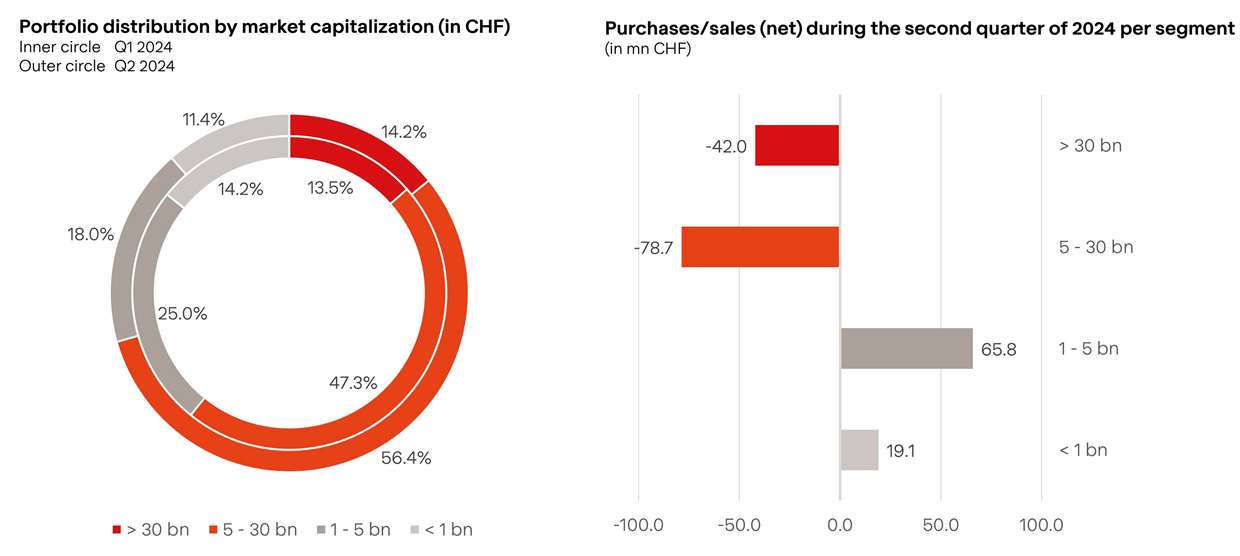

In the second quarter, portfolio adjustments primarily involved capitalizing on gains from larger, established long-term holdings, following through on the investment team’s portfolio rejuvenation that started in the fourth quarter of 2023. This strategy allowed for participation in capital increases, augmenting the more recently initiated holdings and introducing one new position, Edgewise Therapeutics, a company focused on developing therapeutic candidates aimed at regulating key muscle proteins, both for skeletal and cardiac muscles.

Profit-taking activities targeted mid-to-larger entities such as Vertex, Argenx, Intra-Cellular Therapies, Moderna, Neurocrine and Agios, generating a cash influx of USD 139 mn (CHF 126 mn). Capital allocation activity during the quarter included USD 75 mn (CHF 68 mn) to bolster mostly existing newer positions and USD 25 mn (CHF 23 mn) to establish a new stake in Edgewise Therapeutics. BB Biotech participated in the capital increase for Biohaven, a newer position initiated in Q4 2023. Further portfolio enhancements involved additions to our holdings in Annexon, new in the portfolio since Q1 2024, and Immunocore, a holding initiated in Q4 2023. Our shareholding in Celldex was increased, following pipeline progression and a strengthened balance sheet.

By the end of Q2 2024, BB Biotech’s portfolio held 31 positions, maintaining a focus on mid-cap biotechnology firms poised for profitability or with sufficient financial backing to achieve profitability, given their current balance sheet strength. As of June 30, 2024, 28% of the portfolio was invested in early-stage pipeline companies anticipated to require additional funding in the forthcoming years.

Continued high investment level

As the second quarter concluded, our investment level remained near the upper limit of our target range, reaching 113.5%. This sustained high level of investment underscores the management team's continued optimistic outlook with an increasing percentage of the holdings having a de-risked and solid business case at an attractive valuation. The team is committed to adhering to our proven investment guidelines, maintaining investment levels between 95% and 115%.

Portfolio milestones for the second quarter of 2024

Biotechnology markets remained volatile, with substantial valuation gains as well as declines in our investments. Three of our larger holdings, Alnylam, Intra-Cellular Therapies and Agios, have all substantially improved their business outlook following positive Phase III read-outs in the second quarter of 2024. These positive Phase III read-outs are expected to drive significant mid- and long-term revenue and profit growth. Conversely, we experienced substantial performance detractors in some of our smaller capitalized holdings in the second quarter. Such setbacks and valuation losses can result in difficult situations for smaller capitalized companies given high capital required to drive their pipeline assets forward.

The most important milestone for BB Biotech’s portfolio over the last three months was reported by Alnylam. The positive clinical trial result for vutrisiran propelled Alnylam’s share price from a negative year-to-date performance of 20% prior to data read-out to a positive 30% after data read-out.

Alnylam reported positive top-line results for the HELIOS B trial for TTR cardiomyopathy patients. Vutrisiran achieved a 28% and 33% reduction in composite of all-cause mortality and recurrent cardiovascular events, the primary endpoint for HELIOS B in the overall and monotherapy population, respectively. Secondary endpoints were all met. Wall Street’s concerns after Alnylam had to adjust the trial design and statistical plan earlier in 2024 were laid to rest by the positive outcome of the monotherapy arm of the study and, more importantly, by the overall population replicating the positive and clinically meaningful results, which led to the significant rally. The large multi-billion revenue opportunity for vutrisiran to treat cardio TTR patients puts Alnylam in a very good position to become a high growth and profitable large biotechnology company.

Additionally, it triggered a positive cross-read reaction for our largest holding Ionis, albeit much more muted, with Ionis down by about 10% for the first six months of 2024. Ionis and its partner AstraZeneca are developing eplontersen in a large clinical trial for patients with TTR cardiomyopathy, with results expected in the next 18 to 24 months.

The biggest negative detractor in this quarter was Macrogenics, which not only reversed its significant gains seen in the first quarter but also traded back to multi-year lows. Its most recent update for the TAMARACK study for vobra duo in prostate cancer patients disappointed, with the safety profile having worsened substantially from an earlier data cut given higher cumulated drug exposure. Macrogenics lost two-thirds of its valuation and resulted in a drop of 4% for our NAV. Further safety and, more importantly, efficacy data will be presented by the company in the second half of 2024, and a next generation ADC program against the same target is expected to report updates in 2025.

In the second quarter of 2024, our portfolio holdings witnessed significant activity with multiple positive Phase III trials and numerous proof of concept studies yielding results, including:

- Alnylam Phase III HELIOS B trial testing vutrisiran in TTR cardiomyopathy patients reported positive results for both its primary and secondary outcome, as summarized above. With Amvuttra (vutrisiran) approved for patients with TTR polyneuropathy, we expect Alnylam to file for a supplemental NDA in 2024 and to launch Amvuttra in the much larger cardiomyopathy patient population in 2025

- Agios announced that the Phase III ENERGIZE-T clinical study of mitapivat met the primary endpoint and all key secondary endpoints in adults with transfusion dependent alpha- or beta-thalassemia. Mitapivat tested positive to reduce red blood cell transfusion units compared to placebo, with a higher proportion of patients treated with mitapivat achieving transfusion independence. Agios plans a regulatory submission by the end of 2024, for all forms of thalassemia (alpha and beta, transfusion dependent and non-transfusion dependent patients), with a potential approval in 2025. Importantly, Agios expects the Phase III mitapivat trial for sickle cell patients to read out in 2025.

- Intra-Cellular Therapies reported positive topline results in the second Phase III trial evaluating lumateperone as adjunctive therapy in patients with major depressive disorder. Similarly to the first Phase III trial reported in the first quarter 2024, the active arm achieved statistically significant and clinically meaningful results in both the primary endpoint and in key secondary endpoints. Patients treated with lumateperone reported a change in the depression rating scale versus placebo. Intra-Cellular Therapies plans to file a supplemental NDA for the adjunct treatment of major depression disorder in the second half of 2024. If approved in 2025, Caplyta (lumateperone) will be accessible to MDD patients, a much larger market opportunity than the already approved indications to treat patients with schizophrenia and bipolar disorder.

- Annexon, a new position initiated in the first quarter 2024, announced that a single infusion of ANX005 resulted in a significant improvement on the Guillain-Barré Syndrome (GBS)-disability scale. GBS is a rapid and acute neurological disease and treatment with ANX005, an antibody blocking the complement system’s C1q, resulted in a faster recovery. Following the positive update, the company strengthened its balance sheet with a USD 125 mn public offering.

- Moderna is investing heavily in its respiratory virus vaccine franchise and reported on multiple studies in the second quarter. One highlight was the positive Phase III data for the combination vaccine against influenza and COVID-19. mRNA-1083 met its primary endpoint eliciting higher immune response against influenza virus and SARS-CoV2 than when a high-dose licensed flu (Fluzone HD) and COVID vaccines were co-administered in adults 50 years and older. The company is developing single injections covering double and one triple combinations of influenza, RSV and SARS-CoV2, with double vaccines available in 2025 and the triple vaccine expected in 2026.

Negative outcomes, or updates that fell short of Wall Street expectations in early pipeline assets included:

- Macrogenics’ lead asset (vobra duo) Phase II update in metastatic castration resistant prostate cancer, as described above. The deterioration of vobra duo’s side effect profile, with the company reporting multiple grade five (death) events, led many investors to fully discount the asset.

- Sage Therapeutics, still in recovery mode following the complete response letter for zuranolone as treatment for major depression disorder in 2023, is currently launching Zurzuvae for women with postpartem depression (PPD) with its partner Biogen. The company is investing in its pipeline, with dalzanemdor (SAGE-718) being an important mid-stage pipeline asset. SAGE-718 failed to improve cognitive impairment in Parkinson’s disease patients versus placebo in a Phase II trial. Further Phase II trials will read out in the second half of 2024, testing SAGE-718 in patients with Alzheimer disease and Huntington’s disease.

- Immunocore disappointed versus Wall Street’s focus on objective response rate (ORR) of Tebentafusp. With immune oncology targeting agents not achieving tumor shrinkage but rather long-term disease control resulting in survival benefits, the company’s valuation dropped post an early data cut for the company’s PRAME program.

The second quarter also saw one product approval and a notable product label addition:

- Moderna saw FDA approval and CDC recommendation of its RSV vaccine mRESVIA.

- Argenx’s Vyvgart Hytrulo, the subcutaneously administered version of Vyvgart, was approved by the US FDA to treat patients with chronic inflammatory demyelinating polyneuropathy (CIDP).

The flurry of M&A deals and high transaction values in late 2023 cooled off in the first half of 2024, with smaller deals announced. BB Biotech did not participate in any of these smaller to mid-sized public M&A transactions. Vertex, the most heavily capitalized holding in our portfolio, continues to invest in external innovation and announced the acquisition of Alpine Immune for USD 4.9 bn, building out its kidney disease pipeline.

Other corporate actions of note were the substantial purchase agreement announced by Agios for the vorasidenib royalty with Royalty Pharma. Agios is entitled to receive in total USD 1.1 bn upon FDA approval, with the PDUFA action date set on August 20, 2024. Moreover, Incyte announced a share repurchase program, buying back 33.3 mn shares for USD 2 bn, citing the company’s substantial undervaluation and increased pipeline confidence.

Outlook for 2024

As we look towards the second half of 2024, several key factors will play a significant role in shaping the biotechnology landscape and BB Biotech’s performance.

Central bank interest rate decisions remain a pivotal influence on biotech investments. The sector's valuations are notably sensitive to interest rates due to the long-term nature of expected returns. Investors are closely monitoring potential rate adjustments, which will likely impact capital flows into biotech assets in late 2024.

The upcoming US presidential election and potential shifts in congressional power are critical factors to watch. Although healthcare and drug pricing have not dominated early campaign discussions, the focus on specific issues such as pricing of obesity treatments could gain prominence. Policy developments in these areas will be closely monitored for their potential impact on the sector.

Many of our portfolio companies have strengthened their financial positions and de-risked their growth trajectories. This includes significant milestones achieved in the second quarter by Alnylam, Intra-Cellular Therapies, and Agios. These improvements enhance the quality and growth potential of our portfolio. We expect a robust news flow from our portfolio companies, including:

- Arvinas to present pivotal top-line Phase III data from the Veritac-2 clinical study, testing vepdegestrant as monotherapy in second line ER+/HER2- breast cancer patients

- Scholar Rock as well as Biohaven to announce top-line Phase III results for their TGF-beta antibodies for spinal muscle atrophy patients

- Revolution Medicine will provide further clinical data for RMC-6236, its KRAS multi-inhibitor, as well as its G12D inhibitor RMC-9805

- Black Diamond will present initial Phase II results for second and third line non-small cell lung cancer patients with EGFR mutations

- Macrogenics's update on the Phase II TAMARACK study for vobra duo in metastatic castration-resistant prostate cancer patients

- Edgewise to report proof of concept data for EDG-7500 for hypertrophic cardiomyopathy patients and further data for Sevasemten for Becker and Duchenne patients

- Rivus Pharmaceuticals is expected to report Phase IIa clinical data in obese HFpEF for its mitochondrial uncoupler HU6, potentially triggering a further investment by the Series B investors, including BB Biotech

- Relay Pi3Kα is expected to have a top line safety and efficacy data release for its doublet treatment (endocrine therapy plus RLY-2608) and initial safety & tolerability data for a triplet treatment for RLY-2608 combined with endocrine therapy and ribociclib, a CDK4/6 inhibitor

Product approvals expected for H2 2024 include:

- Crinecerfont, from Neurocrine, in congenital adrenal hyperplasia patients for children, adolescents and adults

- Olezarsen, from Ionis, as treatment for familial chylomicronemia syndrome patients

- Axatilimab, from Incyte and Syndax, for the treatment of chronic graft-versus-host disease after failure of at least two prior lines of systemic therapy

The US healthcare system's focus on cost control will intensify with the implementation of the Inflation Reduction Act (IRA). The negotiated discounts for the first ten drugs, set for implementation in 2026/27, will be announced in the fall of 2024. This will be a critical development to monitor.

The expiration of patents for established pharmaceutical pipelines is likely to drive M&A activity. Attractive valuations and promising assets will characterize potential acquisition targets. Following a slow start to the year with mostly smaller deals by pharmaceutical companies, we anticipate increased takeover activity in H2 2024.

Capital markets have improved for pipeline biotech companies, with increased capital-raising activities. Investors are demonstrating renewed willingness to support these companies, enabling them to pursue independent development. Although IPO activity has been limited, the sector is poised for potential equity re-allocation. BB Biotech remains optimistic about the biotechnology sector and its portfolio’s prospects. The combination of strengthened fundamentals, anticipated clinical milestones, and supportive capital market dynamics positions us well to capitalize on opportunities and navigate challenges in the remainder of 2024.

We thank you for your continued trust.

The Board of Directors of BB Biotech AG

Dr. Thomas von Planta

Chairman

Dr. Clive Meanwell

Vice-Chairman

Laura Hamill

Member

Dr. Pearl Huang

Member

Camilla Soenderby

Member

Prof. Dr. Mads Krogsgaard Thomsen

Member