Shareholder letter

Dear Shareholders

In the third quarter of 2024, stock markets remained volatile, with several major equity indices reaching new all-time highs. A key event during this period was the US Federal Reserveʼs decision in September to lower interest rates by 50 bps, marking its first rate cut in four years. This shift signals a potential further easing of monetary policy heading into 2025, with markets anticipating rates to gradually decrease to around 3.5% by the end of 2025. Historically, lower interest rates have been correlated with increased capital flows into sectors such as biotech, as investors seek growth opportunities. This dynamic positions the biotech industry for potential capital inflows as market conditions improve.

The Nasdaq Biotech Index increased by 5.1% in USD during the third quarter. As in the second quarter of 2024 the healthcare sector generally did not keep up with broader equity indices in the third quarter.

For BB Biotech AG, the share price return in the third quarter of 2024 was –9.2% in CHF and –6.7% in EUR. Its third-quarter performance was driven by a widening of BB Biotech’s Net Asset Value discount, from a high single-digit to a low double-digit percentage discount at the end of the third quarter, and by the negative development of the underlying stocks in the portfolio during the same time frame. The portfolioʼs total return was –6.6% in CHF, –4.4% in EUR, and –0.6% in USD. The company’s net loss for the third quarter of 2024 amounted to CHF 157 mn and a net profit of CHF 16 mn was generated in the first nine months of 2024, in contrast to a net loss of CHF 48 mn during the third quarter in 2023 and a net loss of CHF 316 mn in the first nine months of 2023.

For the first nine months of 2024, the total return for BB Biotech’s shares was –11.1% in CHF and –11.0% in EUR. The portfolio performance was +0.3% in CHF, –1.0% in EUR, and –0.2% in USD. All results reported for the first nine months of 2024 include the dividend payment of CHF 2.00 per share in late March 2024.

Portfolio update Q3 2024

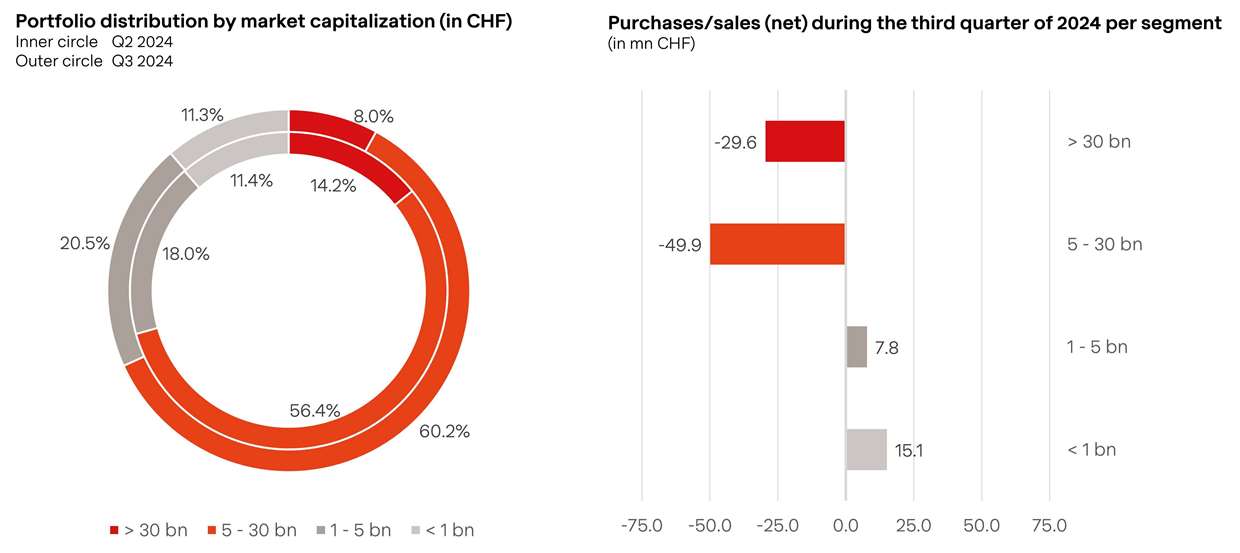

In the third quarter, portfolio adjustments focused on capitalizing on gains from larger, long-term holdings in line with BB Biotech’s S-curve investment strategy. This allowed us to reallocate capital into selectively identified companies with strong growth trajectories, further advancing our continuous portfolio rejuvenation. By rotating investments strategically, we aim to enhance exposure to promising novel assets while staying aligned with our long-term objectives.

At the end of Q3 2024, BB Biotech’s portfolio consisted of 31 positions.

As the third quarter concluded, our investment level decreased slightly but remained near the upper limit of our target range at 112.3%. This sustained high level of investment reflects the management team’s continued confidence, with an increasing proportion of holdings featuring de-risked business models and attractive valuations.

Portfolio milestones in the third quarter of 2024

Biotechnology markets remained volatile, with notable fluctuations across our investments. Several portfolio companies, including Edgewise Therapeutics, Ionis Pharmaceuticals, Rivus Pharmaceuticals, Relay Therapeutics, Wave Life Sciences, and Vertex Pharmaceuticals, delivered positive news, while Exelixis and Neurocrine Biosciences experienced at least market-perceived setbacks. Below, we summarize key milestones from Q3:

- Ionis Pharmaceuticals reported positive results from a completed Phase I/II study in Angelman syndrome, a significant and proprietary orphan disease opportunity. Phase III development is planned for H1 2025.

- Vertex Pharmaceuticals received FDA acceptance of its suzetrigine NDA for acute pain, with a PDUFA date of January 30, 2025. If approved, it will be the first novel pain medication with a new mechanism of action in two decades.

- Alnylam Pharmaceuticals presented groundbreaking results from the HELIOS B Phase III outcomes trial of vutrisiran in ATTR Cardiomyopathy at the ESC Congress in August. With an unprecedented risk reduction of over 30% in all-cause mortality, the therapy is poised to become a multi-billion-dollar blockbuster.

- Neurocrine Biosciences shared top-line Phase II data for NBI-568, a muscarinic receptor agonist, in schizophrenia, which fell short of market expectations. Nevertheless, phase III is set to begin in early 2025.

- Celldex Therapeutics announced positive Phase II results for barzolvolimab in chronic inducible urticaria (CIndU). Phase III development began in July 2024 for chronic spontaneous urticaria (CSU).

- Biohaven reported somewhat unexpected positive pivotal results for troriluzole in spinocerebellar ataxia and plans to submit an NDA to the FDA in Q4 2024.

- Relay Therapeutics provided positive interim data for RLY-2608 in HR+/HER2 metastatic breast cancer, with a pivotal second-line trial expected to begin in 2025.

- Exelixis reported results from a trial investigating Cabometyx (cabozantinib) in combination with atezolizumab, which showed a positive trend towards improved overall survival – one of the trial’s primary endpoints. However, the results did not achieve statistical significance, leading to market-perceived disappointment.

- Rivus Pharmaceuticals, our only private holding, presented positive Phase IIa data for HU6 in obesity-related heart failure at HFSA. The company has also completed enrollment in the Phase IIb M-ACCEL trial with more than 220 patients with readout expected in H1 2025.

- Edgewise Therapeutics, our newest holding, reported positive early healthy volunteer and patient data for EDG-7500. Our investment thesis of separating obstruction gradient reduction from ejection fraction reduction has been validated. We expect additional repeat dose patient data early next year to confirm the potential in hypertrophic cardiomyopathy (HCM) and beyond.

- Wave Life Sciences reported promising interim results for WVE-N531 in boys with Duchenne muscular dystrophy, with feedback on accelerated approval expected in Q1 2025. As a result, we expect the company to advance other exon-skipping assets into the clinic.

Financing and M&A

In the third quarter, several biotech companies raised capital following positive pipeline developments, including Ionis Pharmaceuticals, Relay Therapeutics, and Wave Life Sciences. We typically directly support our portfolio companies in such transactions with capital injections, participating in Relay Therapeutics’s offerings due to key data that aligned with our investment thesis. Ionis Pharmaceuticals’s capital increase was perceived as unexpected, as the company was already well capitalized. While Wave Life Sciencesʼs DMD program showed promise, our focus remains on its AIMers RNA editing platform and A1ATD program, with ongoing updates expected. M&A activity has significantly slowed in 2024 compared to 2023 but may rebound after the U.S. presidential election in November.

Outlook for the remainder of 2024

In September, the US Federal Reserve implemented its first interest rate cut in four years, signaling a shift that could benefit growth sectors like biotech by easing funding conditions. This change, coupled with potential policy shifts, will be important to monitor throughout the remainder of 2024.

The US presidential election and possible shifts in the control of Congress may influence healthcare policy and drug pricing. While healthcare has not been central to campaign discussions, medical costs – particularly drug pricing – remain a key concern for voters. Despite being politically supported by the Biden Administration, the Inflation Reduction Act (IRA) negotiations have had limited impact on cost savings thus far. Key challenges remain, including eligibility timelines for small molecules and biologics, and the orphan drug exemptions. Addressing these issues will likely require bipartisan cooperation. Additionally, as of 2025, Medicare Part D’s USD 2 000 out-of-pocket cap could improve drug adherence and compliance, benefiting the broader healthcare system.

Many of our portfolio companies have strengthened their financial positions, and we are confident that they are positioned for positive clinical news, upcoming approvals, and launches in the months ahead. This view is reinforced by improving capital markets and a gradually reawakening IPO market, signaling renewed investor interest. Within the small and mid-cap space, we have seen multiple positive clinical milestones across the industry and within our portfolio, leading to notable share price inflections, enabling companies to secure funding and move onto new growth trajectories.

BB Biotech remains optimistic about the sector’s prospects. Major patent cliffs are looming for big pharma through the end of the decade and beyond; this will likely drive further M&A activity as organic pipelines struggle to replace lost revenues, generating ongoing consolidation. With our strengthened fundamentals, upcoming clinical milestones, and supportive market dynamics, we are well-positioned to capitalize on opportunities and navigate challenges through the remainder of 2024.

We thank you for your continued trust. As we work through a challenging market environment, we remain committed to executing our strategy and delivering long-term value for our shareholders.

The Board of Directors of BB Biotech AG

Dr. Thomas von Planta

Chairman

Dr. Clive Meanwell

Vice-Chairman

Laura Hamill

Member

Dr. Pearl Huang

Member

Camilla Soenderby

Member

Prof. Dr. Mads Krogsgaard Thomsen

Member